Relationship With Money

This article applies to people interested in understanding the influence of money on decision-making, performance, and relationships and building their relationship with money.

Common Questions:

What is money behavior?

How does money impact behavior?

How do behavior and money connect?

How do I build an enhanced relationship with money?

Solution Overview:

The influence of money is everywhere and this article discusses money behavior and how to approach conversations with people about money behavior to unlock their full potential.

Video Walkthrough:

Details:

Omnipresence of Money

Money is not only a currency for exchange but it represents a part of our mindset and is an energy force omnipresent in every aspects of life. It surrounds us in everything we do, and every day we are having conversations about money or using money. Money impacts us in our sleep because it is deep in our thought patterns. Money impacts our decisions, whether you are spending money on lifestyle, looking at changing jobs, making leadership decisions, dealing with family issues, money is there on the surface and below the surface in terms of your thoughts and stories about money and your behavior patterns with money.

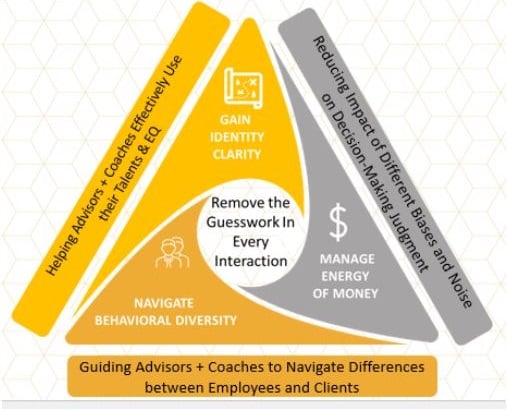

In order to understand money behavior and have clarity about the role of money in your life, it is critical to start with your identity and as a coach or advisor, helping a person understand who they are and buy into that awareness. Next, understanding and navigating behavioral differences, acknowledging that we are all different and have different perspectives, upbringing and experiences and those differences flow through how we deal with money. And third, recognizing how the energy of money is tied to your behavior and how you manage yourself and others expectations and agreements.

DNA Behavior gives you a blend of behavior and money insights to create awareness and empower decision-making. What you see is not necessarily what you get because we all have hidden hard-wired behavioral patterns, financial behavior capability around savings, goal-setting and risk, money energy, and behavioral variability driven by biases that may be masked by surface behaviors of certain activities and situations. The insights in the DNA Behavior system shine light and provide language for discussing those hidden patterns.

Money Behavior Influences

When looking at money behaviors, we can learn a lot about how a person makes decisions and what biases may more strongly influence them based on their two strongest behavioral traits with T Scores over 60 or under 40 (and for some there are more stronger traits). You can learn this by reviewing your Factor and Subfactor report.

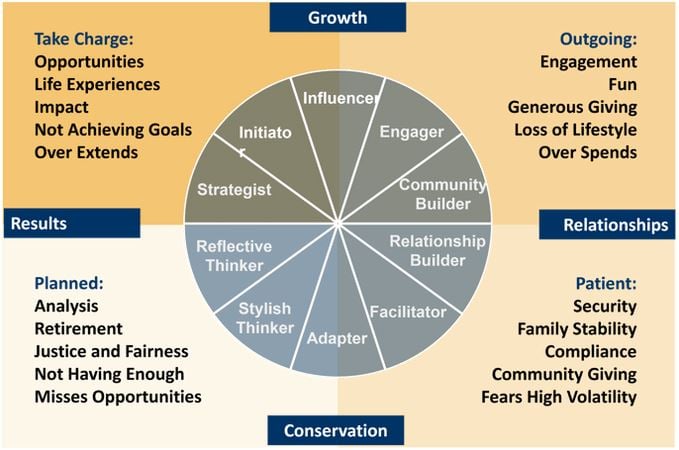

The table below segments money behavior into the four primary behavioral quadrants. For an initial understanding pick your strongest of these four quadrants based on your Factor scores shown in the Factor and Subfactor report.

| Take Charge | Outgoing | Patient | Planned |

| Driver | Promoter | Harmonizer | Protector |

|

A take-charge person who is focused on goals and opportunities to expand their world. |

An outgoing person who desires engagement, openness, and making connections. |

A patient person who is interested in stability, safety, and living with security. |

A planned person who has a need for data and likes to analyze and focus on the tangible. |

|

Over Optimism Bias |

Instinctive Bias |

Loss Aversion Bias |

Anchoring Bias |

|

Over Confidence Bias |

Herd-Follower Bias |

Risk Aversion Bias |

Pattern Bias |

Further, the graphic below describes how people might naturally deal with money based on their Unique DNA Style. We emphasize this is based on natural hard-wired behavior but doesn’t account for learned behavior and more conscious choices they make based on learning and needs. Under stress, you are likely to see these behaviors come out more. It may be useful to share this graph with clients and ask them whether this is true or not true for them to get a money conversation started.

Take Charge styles may be more focused on achievement and driving results. They tend to invest time and money in opportunities to grow and tend to be a high-impact investor and giver.

Outgoing styles may tend to be more life experience focused and building networks and their higher spending nature can show investing in lifestyle and relationships.

Patient styles may tend to favor stability and security and they tend to have a higher loss aversion than others, so with their relational nature ensuring money is managed to provide family stability will be important to them.

Planned styles tend to spend a lot of time on analysis and be more retirement focused than other styles. They may tend to worry about having enough money (no matter how much they have).

Financial Behavior Capability

Financial behavior capability reflects hard-wired natural behavior and is derived by combining sources of natural money energy – budget and savings, wealth creation, and risk-taking.

We believe that being a higher saver is crucial to reducing stress as savings puts control into your life and can give you hope for the future. Also, having savings enables you to take advantage of work, life and financial opportunities which is crucial to making quantum leaps in life.

Certain behavioral styles will tend to have higher natural financial behavior capability and some lower. This doesn’t mean that one can’t create more money energy or be deliberate about taking action that can create, grow and sustain wealth. Initiators and Strategists tend to have naturally higher financial behavior capability whereas Community Builders and Engagers tend to have lower natural financial behavior capability, but ultimately whether you achieve wealth creation and financial capability will come down to the decisions and actions you take in life. What we are talking about here is a natural starting point behaviorally and from there, we need to work on and develop ourselves through conscious living. DNA helps you see your natural starting point so you know where to develop.

Learned Behavior

Each of us has experiences and memories that shape beliefs that drive some of our behavior, personal values, and varying levels of financial education. These learned behaviors influence your financial behavior capability and your success in wealth creation. When people understand their natural behavior capabilities and styles they can direct their learning and decision-making more consciously in order to move toward their desired results.

Having Money Conversations

In the DNA Behavior system, market mood provides a tool to see how people might be feeling about various market conditions based on their natural hard-wiring. This tool helps advisors see market conditions from a client's point of view and suggests ways to approach conversations based on current market conditions.

It is important to recognize that the energy of money is a powerful and sometimes disruptive force, no matter how much of it you have, people have emotional reactions to money.

To have more powerful money conversations we recommend the following model.

Start with the scientific DNA Natural Behavior Discovery so that you have a positive starting place to have a conversation. Using the discovery increases self-awareness and awareness of your client’s behaviors.

Ask powerful behavioral questions that are rooted in the persons behavioral strengths. Get to know more about your client and open their awareness around their own behavioral strengths and patterns to set a positive tone for the discussion.

Listen carefully for their perspectives so you can address their concerns and relate to them on their terms and create a safe environment for the discussion.

Stay in the zone of safety that you have created and help build a plan with them to define what they are going to do and where they are going and create accountability measures to help them stay on track.

The most important thing to remember in a money conversation is the platinum rule. Treat people as they would like to be treated and adapt your communication to your partner or client. Ask the right questions, keep conversations safe, and manage emotions to have productive conversations. Jumping straight to a money conversation can be jarring and derail the conversation. Ease into the money conversation with the following steps:

- Discover your authentic identity and life purpose to get life and money clarity

- Imagine a painted picture of living your quality life and draw it to create focus

- Then, establish the meaning and role of money in your life to power your quality life

Building Your Relationship With Money

The key to increasing your Money Energy and growing your wealth is building a healthy relationship to money.

Treat money as your friend, and on that basis how will you relate to money?

How will you positively think about money when you go to sleep at night? That will be key to the outcome you achieve in your life.

This does not mean you build an unhealthy love of money that is founded on greed and driven by motivations lacking worthiness.

A simple approach to defining your relationship to money is to write a short statement with consideration to who you are (your identity) about how you will earn, save, invest, spend, and give money for the betterment of your life and that of others. Use the behavioral framework provided above to help you.

Related articles:

DNA Behavior Unique Styles

Factor and Subfactor Report

Financial DNA Unlocking Guide

Money Energy Whitepaper

Still Need Help?

Submit a ticket here.

![DNA-B-Primary_White (7).png]](https://kb.dnabehavior.com/hs-fs/hubfs/DNA-B-Primary_White%20(7).png?height=50&name=DNA-B-Primary_White%20(7).png)