Measuring Behavioral Finance Biases

This article applies to advisors using Financial DNA to work with clients on financial biases.

Common Questions:

How do I introduce financial biases to my clients?

What are financial behavior biases?

Solution Overview:

Biases are an inclination of temperament or outlook, especially a personal and sometimes unreasoned judgment: prejudice bent, tendency.

Financial Behavior Biases are inclinations around financial decisions and can be measured as part of your financial personality.

When introducing clients to behavioral biases – it can help to explain that these are “shortcuts” in thinking that they make naturally, which could assist them or blind them in certain decisions. Understanding the biases helps you and your client predict decisions and discuss how that decision is in line with or opposed to the financial plan and goals they have set.

It is helpful to note:

- Every person has a different level of each behavioral bias naturally ingrained in them which is predictable. Therefore, each bias can be measured by the DNA Discovery Process.

- The Financial DNA reporting reflects the predominant or combination of behavioral factors applicable in measuring each behavioral bias.

- The extent to which each bias prevails in decision-making will be determined by the strength of the person’s behavior in one or more factors. Further, some behavioral factors may apply to more than one bias at some level.

- Each behavioral bias can be learned or modified through experiences, values, and education.

- Each behavioral bias, whether natural or learned, can be overcome with behavioral management.

Video Walkthrough:

More on Behavioral Biases

The 16 behavioral biases measured by DNA Behavior are:

Consolidated View: Prefers to look at the aggregate portfolio rather than individual positions

Disposition Effect: May sell winners and hang on to losers for too long

Herd Follower: Tends to stampede into investments in exuberance and out in fear

Mental Accounting: Likes to put money into separate buckets for specific purposes

Loss Aversion: May not realize losses to avoid pain even though values may fall further

Over Trading: Tends to be impatient to get results and may sell at the wrong time

Pattern Bias: Desires order in the face of chaos by looking for predictable patterns in markets

Instinctive: In adversity, tends to make decisions quickly and emotionally based on instinct

Fear of Regret: Hesitant in the case will miss out on a potential gain from the next best thing

Controlling: Tends to control decision-making and take action by yourself without help

Optimism Bias: Exhilarated by playing a big game even if you know it is difficult to win

Status Quo Bias: Likely to take notice of the information that will keep your world the same

Over Confidence: Can think you are more successful at investing than you are

Risk Aversion: Overly hesitant to take the necessary risks to make the required returns

Newness Bias: Likely to give more weight to recent information and ideas

Benchmark focus: Can be fixed on keeping in line with established benchmarks

Biases that can overinfluence caution are:

Disposition Effect

Mental Accounting

Loss Aversion

Pattern Bias

Fear of Regret

Status Quo Bias

Risk Aversion

Benchmark Focus

Work with your clients to increase decision-making confidence.

Biases that can increase/influence Risk-Taking are:

Consolidated View

Herd Follower

Over-Trading

Instinctive

Controlling

Optimism Bias

Over Confidence

Newness Bias

Work with clients to manage expectations down.

Any of these biases not adequately managed can increase the risk of not achieving goals.

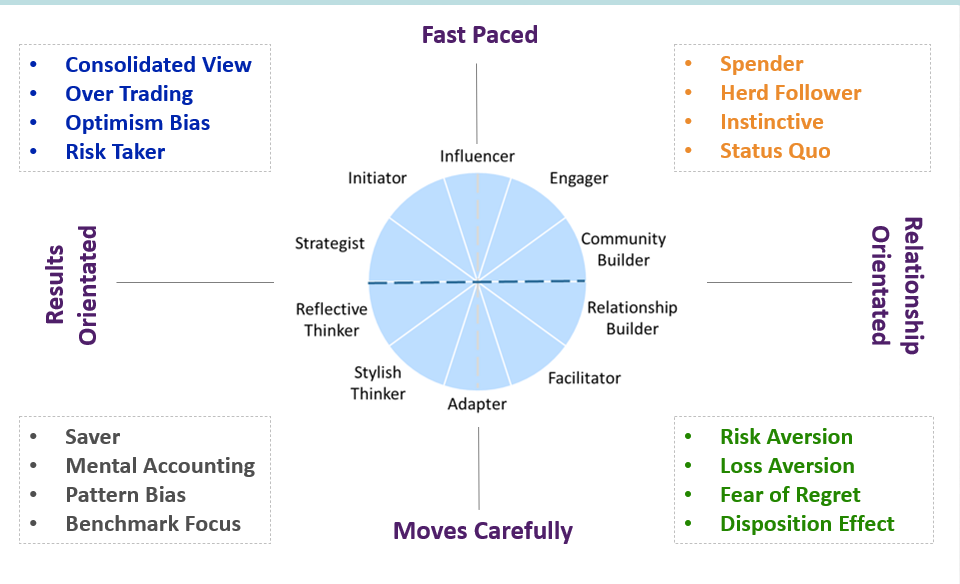

The chart below gives you an idea of how some of these biases can be thought about in terms of your client's style and can help you explain common biases associated with the client's unique style.

Still Need Help?

Submit a ticket Here

![DNA-B-Primary_White (7).png]](https://kb.dnabehavior.com/hs-fs/hubfs/DNA-B-Primary_White%20(7).png?height=50&name=DNA-B-Primary_White%20(7).png)