Financial DNA Learned Behavior Discovery

This article applies to advisors who are seeking to understand how learned behavior impacts the risk-taking propensity of their clients.

Overview:

This article describes how to deploy the Financial DNA Learned Behavior Discovery Process and then interpret the insights for engaging in discussions with clients and in creating a behaviorally smart investment portfolio. This article is not intended to give financial advice, but to help advisors see how to use the FDNA Learned Behavior insights along with the knowledge and needs of their clients to build appropriate investment portfolios.

Completing the Financial DNA Learned Behavior Discovery:

If you would like your clients to complete the FDNA Learned Behavior Discovery, they should go to this self-service link:

Share this link with your clients:

Note: The Financial DNA Learned Behavior Discovery is hosted outside of the DNA Web App. Access this self-service discovery using the following link:

The Financial DNA Learned Behavior Discovery

The FDNA Discovery consists of twelve situational questions and typically takes 5 to 7 minutes to complete. Upon completion, the results will be sent to the participants by email, along with their responses to the questions.

Accessing Client's results:

The Financial DNA Learned Behavior Discovery is conducted separately from the DNA Web App. As a result, the findings are not accessible within the app. After completing the discovery process, participants receive their results via email in the form of a PDF Report. Moreover, they have the choice to share these results with their advisor. If the client decides to share the results with you, you will also receive a copy of the report.

Interpreting the Financial DNA Learned Behavior Discovery Results

The FDNA Learned Behavior report will provide an analysis of the participant’s Risk-Taking Behavior. The Risk-Taking Behavior score is expressed as a Population %, reflecting where the participant is on risk-taking relative to the overall population. This is comparable to the approach taken in measuring population-weighted scores for the Natural Behavior Discovery, which includes natural Risk-Taking Behavior.

The FDNA Learned Behavior Report lists each of the twelve questions and identifies the response provided by the participant.

- For questions 1, 6, 8, 9, 10, and 11, the higher-scored answer will be reflective of a higher Risk Taker.

- For questions 2, 3, 4, 5, 7, and 12, the higher-scored answer will be reflective of a lower Risk Taker.

Using the Financial DNA Learned Behavior Discovery Results and How the Financial DNA Learned Behavior is Different to Natural Behavior

The FDNA Learned Behavior Discovery is a powerful supplement to the Natural Behavior Discovery because of the inherent differences in how each discovery process measures risk. The FDNA Learned Behavior Discovery involves the participant responding to situationally worded questions which means the responses will change as situations and circumstances change. Whereas the Natural Behavior Discovery uses a deliberately structured Forced Choice Scoring Model to measure non-situational behavior, including risk-taking.

The FDNA Learned Behavior insights do give advisors a good start for how clients have consciously decided to behave in the current circumstances. It will reflect the present comfort level they may have with various investment portfolios.

The FDNA Learned Behavior Risk Taker score can be directly compared to the Natural Behavior Risk Taker Score. The difference will be reflective of how the participant has consciously learned to adapt their risk-taking decisions based on what they have learned and experienced through environmental circumstances, education and their values.

For instance, a naturally cautious person may consciously decide to take greater risks because of their greater investment knowledge and with that increased comfort. In our experience, this happens with financial advisors. However, when an investor decides to take additional risk above their natural behavior, then that requires a greater discussion with the advisor. The issue is that in these circumstances the investor may “flip back” to their natural behavior when under pressure and decide to sell some or all of their investments at the wrong time through their emotions being triggered.

The opposite situation also occurs. In these circumstances the person is naturally a high risk taker but decides to dial down their investment risk taking because of learned experiences and perhaps caution about market conditions in the future. The issue then becomes that they will miss the higher returns from taking more risk and can become judgmental of the advisor for this situation if it is not properly understood.

Financial advisors should never rely solely on the FDNA Learned Behavior results for building an investment portfolio for clients. Client needs, market conditions, time to retirement, and other variables should always be considered in creating an investment portfolio.

Ultimately, the difference between the Learned Behavior and Natural Behavior with respect to risk-taking requires a discussion between advisor and client. Further, the discussion should be documented by the advisor.

The FDNA Natural Behavior Discovery reporting indicates an investment portfolio grouping for clients as a starting place based on the strength of their Natural Behavior Risk Taking score. Ultimately, with the knowledge of the Learned Behavior Risk-Taking score, a decision has to be made between the advisor and client as to what level of risk will be taken for the various investment buckets (short term needs, retirement, strategic and for other specific goals) in the overall portfolio.

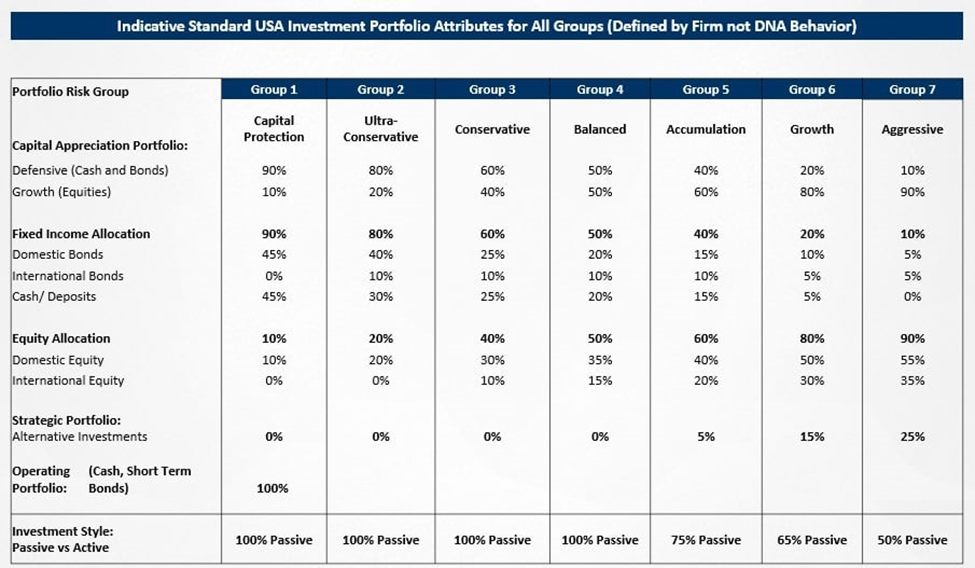

The seven-portfolio group model used by DNA Behavior is based on the population weighting for the Risk Behavior score as follows:

- Group 1 – 0 to 2%

- Group 2 – 3% to 16%

- Group 3 – 17% to 30%

- Group 4 – 31% to 69%

- Group 5 – 70% to 83%

- Group 6 – 84% to 97%

- Group 7 – 98% to 100%

The seven behavioral groupings used by DNA Behavior are described below:

Many advisors use a goals-based behavioral portfolio design and apply the seven investment portfolio groups as follows:

Operating Portfolio (“Preservation”) – Preserves principal, generate income and minimize volatility. Amount: Min 6-12 months cash for daily activities (short-term needs and wants), up to 3 to 5 years cash for retired person. (Risk Portfolio Grouping 1)

Capital Appreciation (“Accumulation”) – Manage volatility but focus on appreciation to generate future purchasing power for building retirement capital (long-term needs). Amount: 5 to 10-year horizon. (Risk Portfolio Grouping 2 to 7)

Strategic Portfolio (“Speculative”) – Designed to meet special objectives, generate high returns or cash flow, and are less liquid. Amount: Long-term horizon and can be lost without retirement damage (long-term wants). (Risk Portfolio Grouping 5 to 7)

Further, the advisor's recommendations should also consider the client’s financial capacity, investment experience, and investment education.

![DNA-B-Primary_White (7).png]](https://kb.dnabehavior.com/hs-fs/hubfs/DNA-B-Primary_White%20(7).png?height=50&name=DNA-B-Primary_White%20(7).png)