Identifying Risk Profile with DNA Behavior

How to identify a risk portfolio for a client that accounts for multiple situations and remains consistent with client behavior.

Applies to:

This article applies to financial advisors and coaches looking to learn more about clients' ability to take and handle risks, especially in a financial portfolio.

Common Causes/Issues:

How to identify a risk portfolio for a client that accounts for multiple situations and remains consistent with client behavior.

Solution Overview:

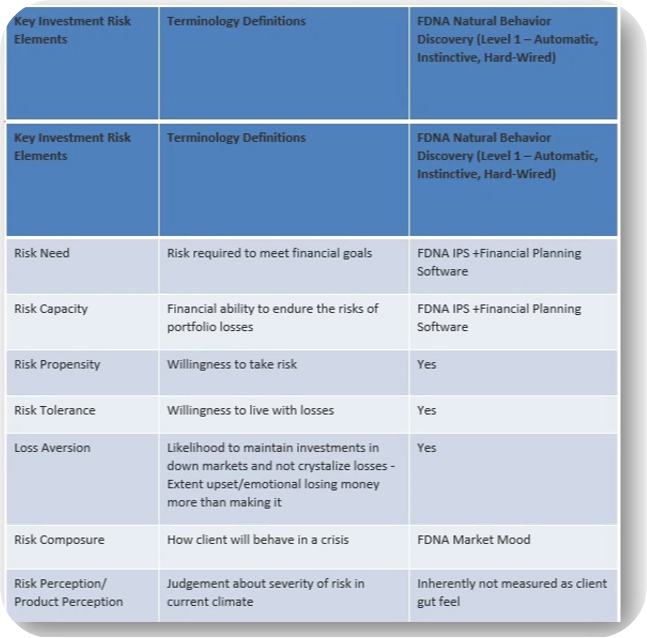

Traditional risk profiling models are based on 5 to 25 questions. These questions are highly situational, meaning the results can change over time; generally, the outcomes are not reliable enough to predict behavior. Further, they are one-dimensional, only telling you about the client’s propensity to take investment risks. They do not tell you about the client’s financial personality at the broader level, including behavioral biases that, if not managed, can cause more significant risk for clients.

Video Walkthrough:

Note: the system has been updated recently, and some items mentioned in the video may have changed.

Details:

The DNA system will report both Risk Propensity for Taking Chances and Risk Tolerance for Living with Loss. When there is more than a 20% difference in these scores, your clients are at risk for emotional reactions and irrational behavior if not managed properly. In more than 20% of clients, the difference between risk propensity and risk tolerance is 20% or more.

Advisors will want to invest down from propensity to keep clients on track regarding risk tolerance and reactions that may occur with market volatility.

To build out a plan:

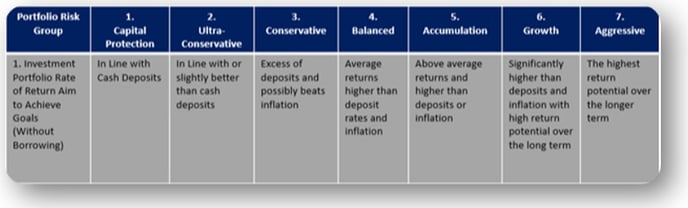

- Your Assessment of the Client’s Current Portfolio Risk Profile Group

- Your Assessment of the Client’s Portfolio Risk Need Group to Achieve Goals

- Your Assessment of the Client’s Portfolio Risk Group based on Current Financial Risk Capacity

- Financial DNA Natural Behavior Portfolio Risk Group (based on Risk Propensity and Tolerance)

- Financial DNA Learned Behavior Portfolio Risk Group (From Financial Personality Discovery or Advisor’s Assessment of the client)

- Overall Selected Portfolio Risk Profile Group (Selected by Advisor and Client based on a discussion of the aggregate of all scores)

Approach: 1. Do not set the Risk Profile higher than the Risk Need (to achieve the goals).

2. Build the portfolio within +/- 1 Grouping of the Natural Behavior Portfolio Risk Profile Group, reflecting the long-term “go-to” default behavior.Subject to:

- Review the client’s Risk Need (to achieve goals) and Risk Capacity (financial ability)

- The client’s Learned Risk Behavior Motivations (experiences, education, environment)

Still Need Help?

Submit a ticket here.

![DNA-B-Primary_White (7).png]](https://kb.dnabehavior.com/hs-fs/hubfs/DNA-B-Primary_White%20(7).png?height=50&name=DNA-B-Primary_White%20(7).png)