Financial DNA Implementation Process

This article is for financial advisors, wealth managers, coaches, and consultants who are seeking to implement the Financial DNA Discovery Process in their business to know, engage and grow their clients.

This article is for financial advisors, wealth managers, coaches, and consultants who are seeking to implement the Financial DNA Discovery Process in their business to know, engage and grow their clients. Further, how the clients can be guided to discover their financial behaviors so that a customized financial planning experience can be delivered based on their unique style.

Common Questions:

- How has the role of a financial advisor evolved to behavioral coach or wealth mentor for the delivery of a client-centric service?

- How does Financial DNA® contribute to the financial planning discovery process? Could you elaborate on how it is incorporated and what benefits it brings?

- In what ways does the wealth mentoring process guide individuals in discovering their true selves and establishing priorities for building a Quality Life? Can you provide examples or explain the techniques used in this process?

- Could you elaborate on the distinction between an advisor and a wealth mentor? What are the key characteristics or responsibilities that differentiate the two roles?

- Can you further explain the concept of being a "behavioral guide" and how it relates to leading clients toward a quality life guide? How does the transfer of wisdom and the role of a co-collaborator play into this process?

Solution Overview:

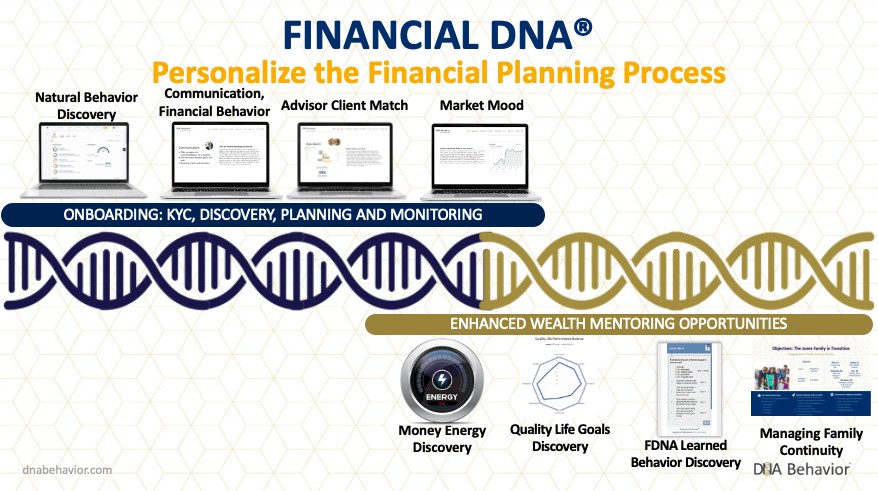

Financial planning focused on behavioral identity, unique financial personality and building an relationship to money is the differentiator DNA Behavior brings to financial planning. With this insight, a customized financial plan can be built personalized to the client using the pin-pointed DNA insights.

DNA Behavior Propels Advisors to Deliver Customized Financial Plans:

If you work as an advisor, wealth manager, coach, or consultant, helping individuals and families with their life and financial choices, the Financial DNA® Journey Map Overview is designed to improve your strategic approach by integrating Financial DNA®.

Wealth Mentoring is a relational undertaking that entails guiding others and utilizing wisdom to help them uncover their true selves and establish their priorities for a Quality Life. This is achieved through a mutually beneficial exchange of personal life experiences and insights.

Transitioning from being an advisor to becoming a wealth mentor is essential for delivering personalized financial guidance. The conventional advisory approach primarily revolved around being a financial planning technician, investment manager, and financial educator. However, as a Wealth Mentor, your role transforms into that of a behavioral guide, leading clients toward achieving a quality life. You share your wisdom, act as a collaborator, and provide a supportive sounding board for your clients.

Financial DNA Implementation

![DNA-B-Primary_White (7).png]](https://kb.dnabehavior.com/hs-fs/hubfs/DNA-B-Primary_White%20(7).png?height=50&name=DNA-B-Primary_White%20(7).png)