Building A Behavioral Investment Portfolio

Applies to Financial DNA (FDNA) users and how to use behavioral insights to build financial portfolios.

Common Question:

How can I set up a behaviorally smart portfolio?

How do FDNA profiles relate to creating investment portfolios?

Solution Overview:

This article describes how to use FDNA insights in creating a behaviorally smart investment portfolio. This article is not intended to give financial advice, but to help advisors see how to use the FDNA insights along with the knowledge and needs of their clients to build appropriate investment portfolios.

Video Walkthrough:

This video was created prior to the system upgrade. Some of the items mentioned in this video may be different in the new system. If you have questions, please contact support.

Details on Building a Behavioral Portfolio

Financial advisors should never rely solely on FDNA results for building an investment portfolio for clients. Client needs, market conditions, time to retirement, and other variables should always be considered in creating a portfolio. The FDNA insights do give advisors a good start for how clients will behave and the comfort level they may have with various investment portfolios. The FDNA system can indicate a portfolio grouping for clients as a starting place based on the strength of their Risk Behavior score.

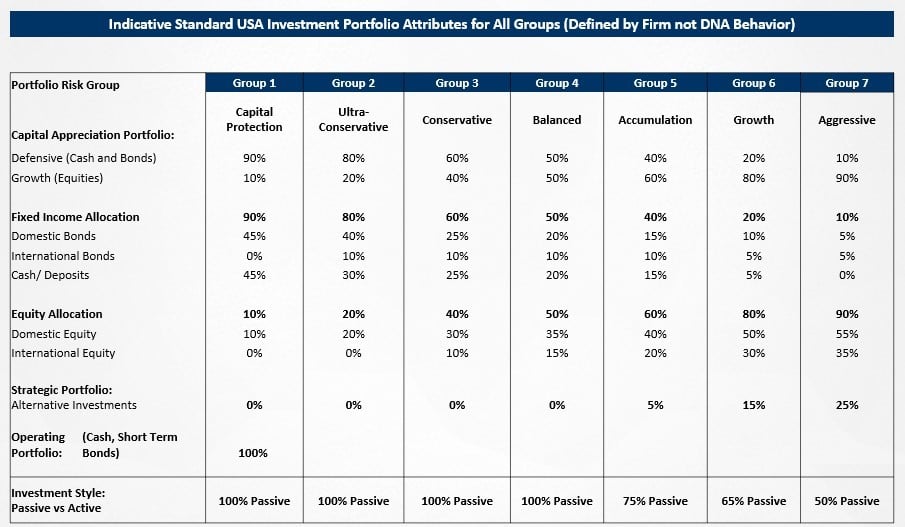

The seven-portfolio group model used by DNA Behavior is based on the population weighting for the Risk Behavior score as follows:

Group 1 – 0 to 2%

Group 2 – 3% to 16%

Group 3 – 17% to 30%

Group 4 – 31% to 69%

Group 5 – 70% to 83%

Group 6 – 84% to 97%

Group 7 – 98% to 100%

The seven behavioral groupings used by DNA Behavior are described below:

Many advisors use a goals-based behavioral portfolio design and apply the seven investment portfolio groups as follows:

Operating Portfolio (“Preservation”) – Preserves principal, generate income and minimize volatility. Amount: Min 6-12 months cash for daily activities (short-term needs and wants), up to 3 to 5 years cash for retired person. (Risk Portfolio Grouping 1)

Capital Appreciation (“Accumulation”) – Manage volatility but focus on appreciation to generate future purchasing power for building retirement capital (long-term needs). Amount: 5 to 10-year horizon. (Risk Portfolio Grouping 2 to 7)

Strategic Portfolio (“Speculative”) – Designed to meet special objectives, generate high returns or cash flow, and are less liquid. Amount: Long-term horizon and can be lost without retirement damage (long-term wants). (Risk Portfolio Grouping 5 to 7)

Further, the advisor's recommendations should also consider the client’s financial capacity, investment experience, and investment education.

Still Need Help?

Submit a ticket here.

![DNA-B-Primary_White (7).png]](https://kb.dnabehavior.com/hs-fs/hubfs/DNA-B-Primary_White%20(7).png?height=50&name=DNA-B-Primary_White%20(7).png)