Behavioral Finance Study - 5 Facts from 35000 Investors

This article is for leaders, coaches, consultants, advisors, and those interested in the February 2019 DNA Behavior extensive behavioral finance study.

Common Questions:

- Do you have findings and analysis from a significant test group to determine how investors make decisions from a behavioral standpoint?

Solution Overview:

An investor’s decisions and actions may sometimes seem like wild cards. The truth is that their behavior is predictable with each decision, goal, or emotion. We call this your Financial DNA®.

Behavioral Finance Study

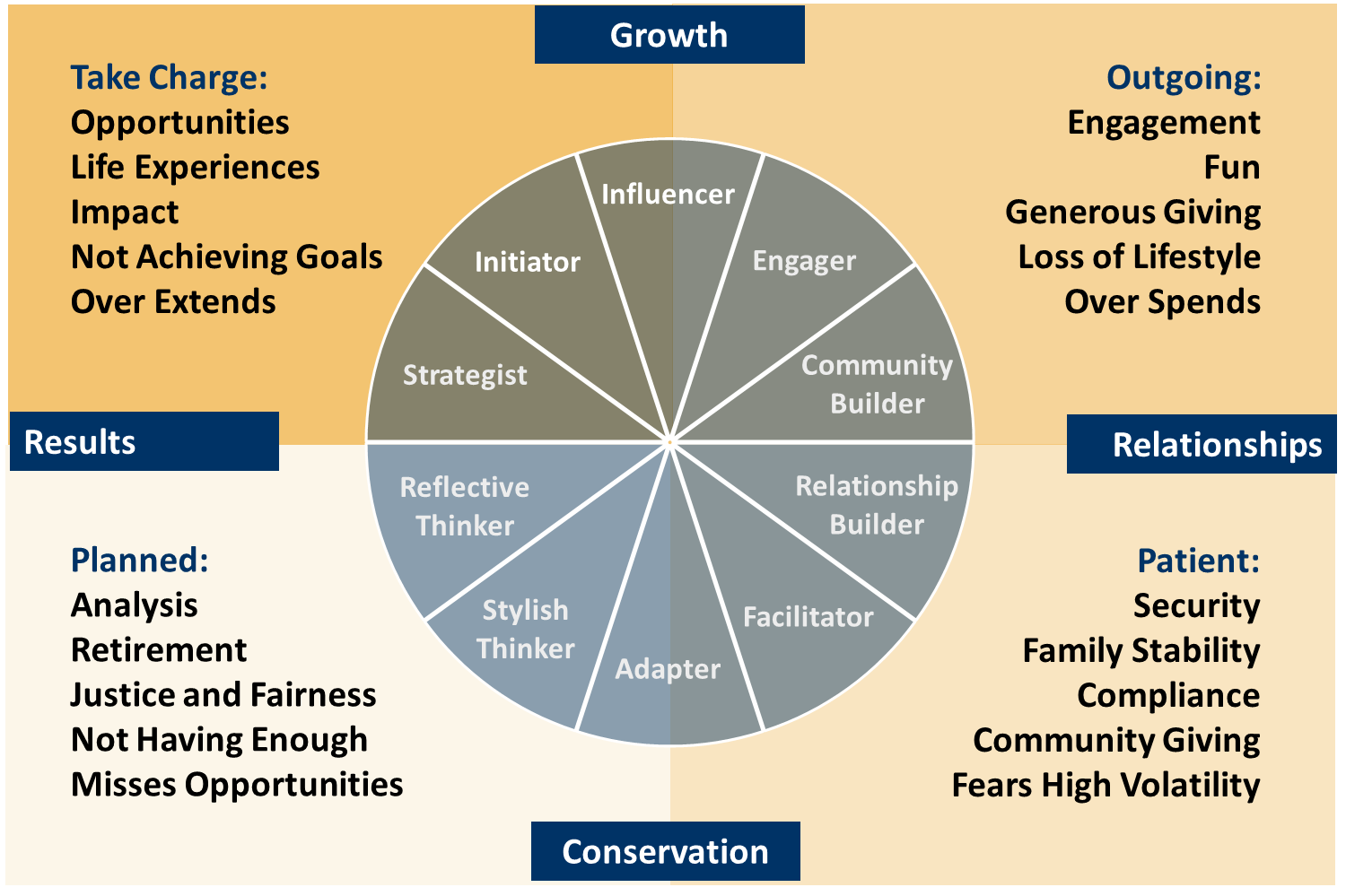

In February 2019, DNA Behavior International conducted an extensive behavioral finance study utilizing demographic data from 35,000 investors. The study encompassed sixty-four behavioral finance insights from each investor, employing the scientifically validated DNA Discovery Process. The research revealed that an investor's behavior permeates various aspects of their life, including spending, saving, goal setting, and risk tolerance.

Here are five noteworthy findings derived from the analysis of these 35,000 investors:

- Among the highest spenders, individuals with Influencer and Initiator DNA unique styles were predominant. These individuals exhibited a vigorous drive towards achieving goals and sought life experiences. The discretionary spending category where they allocated the most resources was dining out.

- On the other hand, the lowest spenders belonged to the Stylish Thinker DNA unique style. These individuals adopted a more structured approach to life, resulting in average spending that was 30% lower compared to Influencers and Initiators.

- Our data indicate that individuals with a higher inclination towards risk-taking, especially those possessing the Take Charge trait, tended to have higher earnings on average. However, among the top earners, most fell into the lower middle range of risk-taking groups.

- It was observed that individuals categorized as higher Risk-Takers tended to reside in more affluent neighborhoods and displayed a higher propensity for borrowing funds for housing purposes.

- Cautious investors, characterized by risk aversion, tended to hold the most significant amount of equity in their homes, with an average value of $200,000.

Overall, this comprehensive study provided valuable insights into the behavioral patterns of investors, shedding light on the connections between their behaviors and financial outcomes.

For more information, please read the following booklet: DNA Behavioral Finance Study - Five Facts from 35,000 Investors

![DNA-B-Primary_White (7).png]](https://kb.dnabehavior.com/hs-fs/hubfs/DNA-B-Primary_White%20(7).png?height=50&name=DNA-B-Primary_White%20(7).png)